Trust the Math Not the Middleman

You've heard the term "blockchain" everywhere, from investment banking conversations to discussions about digital art. But stripped of the hype, what is this technology, and why is it transforming how businesses operate?

At its core, a blockchain is a decentralized and distributed digital ledger system. Imagine a shared, tamper-resistant record book that isn't stored in one bank vault, but spread across thousands of independent computers, or nodes, across a network. This structure gives the ledger resilience and provides a single, agreed-upon source of truth for all participants.

Blockchain is currently being deployed by enterprises for settlement, identity, and supply chain traceability, moving the technology rapidly from pilot programs to production.

What Exactly Is a Blockchain?

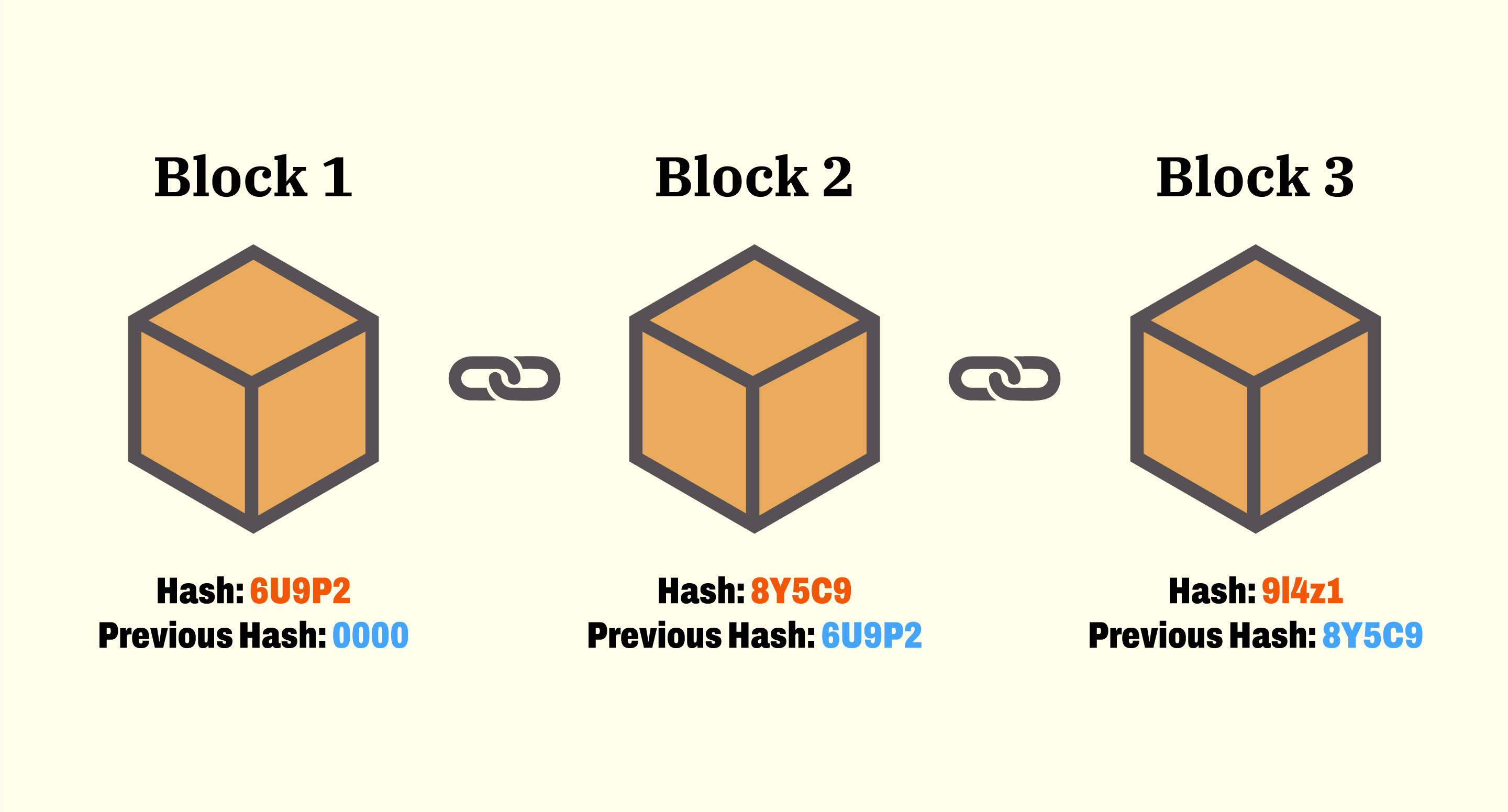

A blockchain records transactions by chaining data blocks together securely.

The Chain of Blocks

Every time an event or transaction occurs (say, sending digital assets to a friend), it is grouped into a block of data. When a block is full, it gets cryptographically sealed and permanently linked to the block that came before it. The entire history of transactions forms a blockchain—a secure chain of immutable records.

Source: What Is Blockchain?

Crucially, once data is written into a block, it cannot be altered. If a record is wrong, a new transaction must be added to reverse the error, meaning both the mistake and the reversal remain visible. This design makes the records tamper evident and tamper resistant.

Cryptography and Consensus

Two key mechanisms enable this tamper-proof system:

- Cryptography: Each block is linked using a cryptographic hash, which acts as a unique digital fingerprint. This design makes it nearly impossible to alter any single block without changing the hash of every subsequent block, which would be detected by the network. Furthermore, users leverage asymmetric-key cryptography (public and private keys) to digitally sign transactions, verifying the authenticity and integrity of the transfers.

- Consensus: Because there is no central bank or middleman, every transaction must be verified by the decentralized network of users. The agreement on the valid state of the ledger is reached through a consensus model.

- Proof of Work (PoW): Used by early systems like Bitcoin, this requires nodes (miners) to compete using massive computing power to solve a complex puzzle to add the next block.

- Proof of Stake (PoS): Used by systems like Ethereum, this chooses validators based on how much cryptocurrency they have "staked" or invested in the system, requiring commitment and capital rather than raw computing power.

Both consensus methods achieve the same goal: they agree on the truth without needing a central authority.

Beyond Crypto Real-World Use Cases

While widely known for powering cryptocurrencies like Bitcoin, blockchain’s applications extend far beyond electronic cash.

The fundamental benefit of blockchain is its ability to build trust, transparency, and security across organizational boundaries without relying on traditional intermediaries.

Key Benefits

| Benefit | Detail |

|---|---|

| Efficiency and Cost Reduction | Reconciliation time between financial institutions or supply chain partners is cut dramatically. Organizations using blockchain have reported a 30–40% reduction in reconciliation time and a 20–30% decrease in transaction costs in the first year. |

| Traceability | Provides a transparent audit trail of an asset’s entire journey. This ensures authenticity and helps verify the origin of goods. |

| Automation | Smart contracts—self-executing agreements stored on the blockchain—automatically trigger actions when predetermined terms are met, enhancing efficiency and reducing the need for manual intervention. |

Practical Applications

- Supply Chain Management: Global manufacturers struggle with limited visibility and counterfeit goods. By using blockchain, all participants can share real-time updates with an immutable record of provenance. For example, Walmart uses blockchain to trace food products back to their source in 2.2 seconds, improving safety recalls and compliance.

- Finance and Settlements: Blockchain improves settlement efficiency and reduces costs. Financial institutions are leveraging systems like JPMorgan’s Onyx platform for tokenized payments that settle faster and cheaper. Enterprise systems often utilize permissioned platforms like Hyperledger Fabric or Corda to handle regulated workflows, ensuring compliance and tightly controlled access.

- Data Management and Identity: Beyond assets, the technology is used for data management and securing digital identity verification.

- Decentralized Applications (dApps): Developers are creating dApps to build tokenized assets (like real estate or art) and decentralized finance (DeFi) systems that replace traditional banks.

The Future is Shared

Blockchain is no longer just a theoretical concept; it is delivering practical business value today. As over half of organizations are expected to run at least one blockchain platform in production by 2027, this technology is accelerating adoption across nearly every major industry. The lesson is clear: for problems requiring multiple parties, auditability, and trust without a middleman, blockchain is quickly becoming the digital foundation of choice.

Want to explore more articles like this? Sign up for free with Exabyte Tech!

Sources: